Exploring the Various Kinds Of Insurance Policy and Their Vital Incorporations

In the intricate world of economic security, insurance coverage stands as an essential safeguard, spanning from health to home. Whether it's the extensive protection of health insurance policy, the encouraging structure of life insurance policy, the essential guards of vehicle insurance policy, or the safety welcome of home insurance policy, recognizing these plans is essential.

Comprehending Comprehensive Health And Wellness Insurance Coverage Protection

The range of insurance coverage can vary commonly depending upon the strategy and the copyright chosen. Some plans use fringe benefits like dental and vision care, mental health and wellness solutions, and alternative treatments such as acupuncture or chiropractic care. Premiums, deductibles, copays, and coinsurance prices are additionally vital factors that impact the general price and accessibility of the insurance.

Choosing the ideal detailed wellness insurance policy calls for recognizing one's health needs and comparing different plans to find the very best match in terms of coverage extent and cost-effectiveness. This careful consideration aids make certain that people are adequately covered without overspending.

The Relevance of Life Insurance Policy and What to Consist of

The trick incorporations in a life insurance policy policy must be very carefully picked to match the insured's financial and individual situation. A term life insurance policy, for instance, appropriates for those looking for insurance coverage for a certain duration, commonly up until significant financial obligations are paid or youngsters are monetarily independent. Whole life policies, on the other hand, deal long-lasting protection and can accumulate money value, working as a prospective resource of financings or withdrawals in the future. Appropriate protection makes certain best site that financial responsibilities are fulfilled, therefore providing assurance.

Key Features of Vehicle Insurance Coverage

Auto insurance policies include a selection of attributes developed to secure drivers economically in case of a mishap, burglary, or other automobile problems. Responsibility protection is essential, covering expenses connected with death, residential or commercial property, or injury damage triggered to others by the policyholder. Crash insurance policy spends for repair work to an insurance holder's automobile after a mishap, no matter fault.

Comprehensive insurance coverage prolongs beyond mishaps, covering automotive damages from all-natural disasters, vandalism, or theft. Injury defense (PIP) is also vital, covering medical costs for the vehicle driver and guests regardless of that is at fault. In addition, uninsured/underinsured vehicle driver insurance coverage guards insurance holders from losses sustained if an accident is triggered by a motorist without ample insurance policy.

Each of these components plays an essential role in offering financial security in diverse situations, ensuring that insurance policy holders can navigate post-accident situations with greater ease and less economic concerns.

Basics of Home Insurance Policy for Secure Living

While vehicle insurance policy safeguards versus automotive risks, home insurance gives essential security for homeowners against residential or commercial property damages and liability. It's critical for home owners to comprehend the various elements of home insurance to guarantee thorough insurance coverage.

Homeowners ought to meticulously analyze their plan limitations and consider extra protection choices like flood or visit the site earthquake insurance coverage, which are often omitted from common policies. Regularly assessing and upgrading protection is suggested to equal changes in residential property worth and personal belongings. Home insurance is not just a legal requirement yet a considerable facet of financial safety and security for home owners.

Conclusion

Finally, comprehending the different kinds of insurance is crucial for comprehensive monetary defense. Health and wellness insurance policy guarantees accessibility to required medical treatment, while life insurance coverage offers security for dependents. Auto insurance coverage covers possible vehicle-related expenditures, and home insurance coverage original site protects one's residence and items. Each type of insurance coverage uses specific advantages, highlighting the significance of tailored policies to fulfill specific requirements and situations, thus making certain and securing assets satisfaction.

Whether it's the thorough insurance coverage of health insurance coverage, the encouraging structure of life insurance policy, the needed shields of auto insurance coverage, or the safety accept of home insurance, comprehending these policies is crucial.Thorough health insurance coverage offers a considerable variety of clinical advantages, securing policyholders from significant financial burdens in the event of clinical emergencies.While car insurance safeguards versus car dangers, home insurance coverage gives important protection for house owners against home damages and liability. Wellness insurance coverage guarantees accessibility to essential medical treatment, while life insurance supplies safety for dependents. Auto insurance policy covers potential vehicle-related costs, and home insurance policy protects one's home and items.

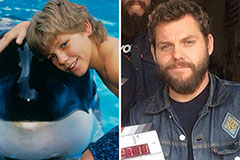

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!